The COVID-19 pandemic has changed the way many of us work and earn a living. Participation in the gig economy has increased significantly since the pandemic started, causing many individuals to pursue contract or freelance work for primary or additional income. As of 2019, there are

57.3 million freelancers

in the United States. In the next five years, studies predict that freelance workers will make up

more than half

of the U.S. workforce.

While freelancing and gig work is a great way to make money while enjoying work-life balance, one common concern is the lack of employer-sponsored benefits available to contract workers.

How life insurance supports freelancers

Many freelancers are familiar with fluctuating income month to month, leaving a bit of uncertainty when it comes to managing budgets and recurring expenses.

Life insurance

is one important expense that could be very risky to cut out of your budget. A policy with comprehensive coverage can be very affordable and coverage could be priceless if you were to pass away unexpectedly.

Benefits of life insurance for freelancers

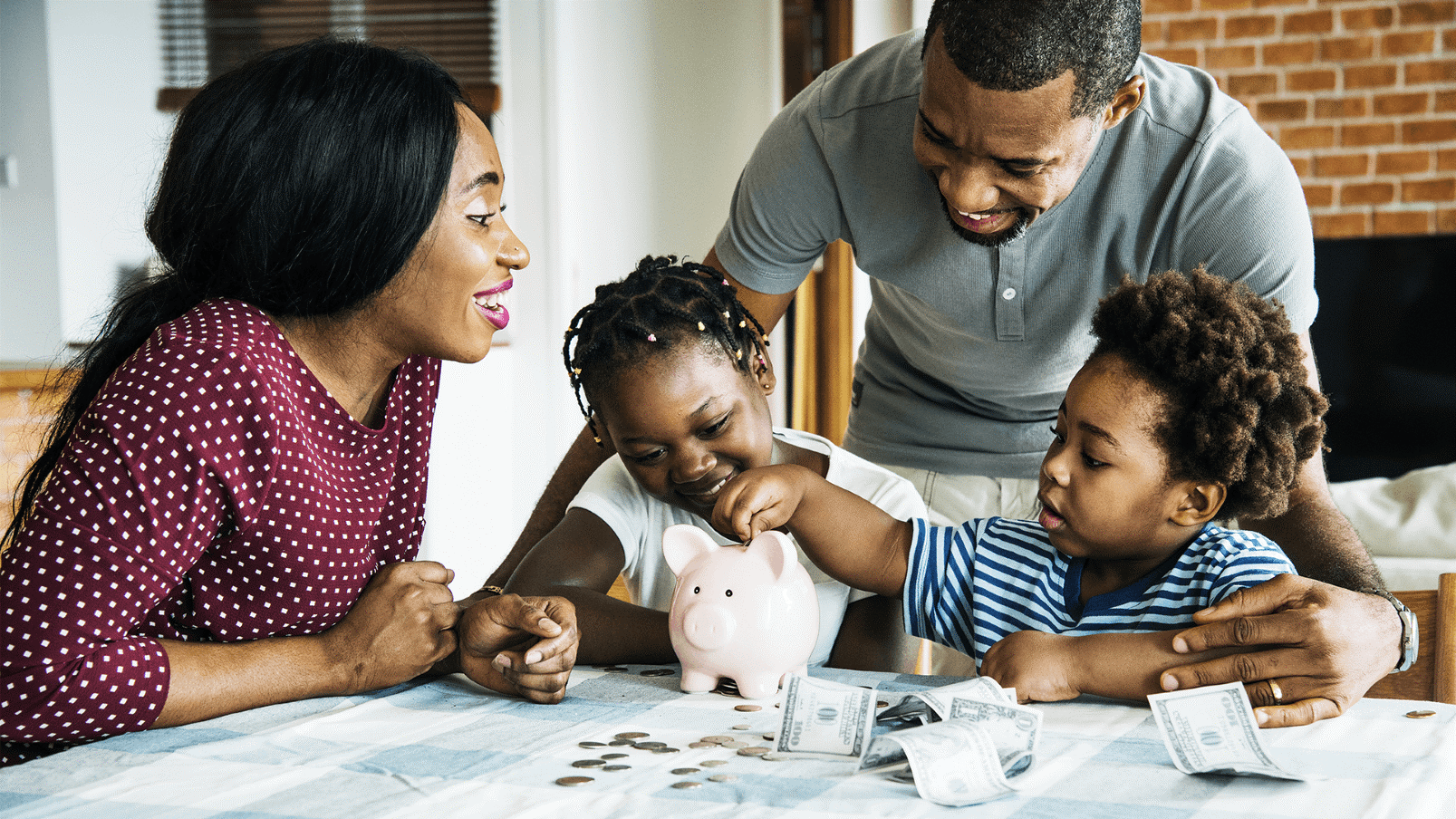

The main benefit of having life insurance as a freelancer or gig worker is the financial protection it offers for your loved ones. If you have a mortgage or would leave behind debt if you were to pass away, life insurance can step in and cover these costs for your loved ones so they aren’t left with a financial burden.

Life insurance benefits for freelancers:

-

Affordable premiums can be paid monthly or annually

-

Term amount only lasts for the years you need coverage

-

Can cover business debt if you pass away unexpectedly

-

Return of premium rider could provide a full refund of premiums paid if the policy goes unused

-

Tax free benefit paid to loved ones

-

Can make your insurance premiums if you were unable to work*

*Available in most states. Limitations may apply. Benefits and carriers will vary for coverages and are subject to underwriting approval, product limitations and availability

What life insurance policy is best for a freelancer

Term life insurance

is usually the best option for freelancers. With term life insurance, you can choose how many years you need coverage and choose a coverage amount that fits your needs. Policies generally range from 10-30 years. Term life is one of the most affordable types of life insurance on the market, and a healthy individual could get coverage for as low as $20 a month.

Since premium prices depend on your age and health at the time you apply for coverage, it’s important to get a policy in place sooner rather than later. It’s also important to note that you’d likely pay a higher premium for a 30+ year term length because the likelihood of payout for the insurance company increases with the length of the policy term.

A 10-20 year

term life policy

is an affordable way to get the coverage you need, with an added bonus of peace of mind knowing your loved ones wouldn’t face a financial burden if you pass away.

Find the right price by connecting with a Symmetry Financial Group licensed agent

Life insurance can be intimidating, especially with all the options available. Working with a licensed agent is a smart way to find the most affordable life insurance policy with the benefits to match your needs. With access to over 30 of the top insurance carriers, your Symmetry agent can shop around for you to find the best term life policy for your needs.

Save yourself the hassle of research, phone calls, and checking price tags all over the internet and schedule a virtual consultation with a Symmetry agent, who can present all your options to you free of cost.

To get started,

request a quote

for term life insurance today.